The sorry state of the blockchain

Ecosystems are usually characterized by the people inside them. These people define their direction and the rhythm of progress.

Bitcoin was born in 2008 as a response to the problem of trust, in this case in banks, who abused of their power and relentlessly drove us to the crisis we’re still in.

I first got into Bitcoin when it was released in 2009, but it wasn’t until 2012 that I actually read the whitepaper and understood the magic (well, the math) behind it.

At that time, Bitcoin was formed by a vibrant community of hackers, anarchists and libertarians extremely passionate about how they could rebuild society and enhance it using technology.

Of course, as everything financial-related, and starting to have more and more media coverage, Bitcoin started to attract outsiders who valued it not because of the positive impact that it could have in future’s society, but just because they could trade and make fast money — that’s fine, more volume usually means more interest on it, so it eventually drives the prices up, making it more profitable for miners to invest more, resulting in a stronger network, demonstrating Bitcoin’s viability.

Companies using Bitcoin started appearing, raising VC money, which was great because usually entrepreneurs are crazy enough to push the boundaries of technology and bring brand-new tech mainstream.

However, in some point during late 2015, a huge influx of people coming from the banking, consulting and law industries (from corporate backgrounds in general) came to the industry, attracted by the idea of applying the concept behind a decentralized ledger to their companies — somehow believing that blockchain is the solution for all their problems.

This created a snowball of hype, that over the course of months, brought us to a sorry state of our community, once driven by the ambition to enhance humans, by empowering freedom thanks to technology, but now driven by money being made by confusion.

The best example of this confusion are the so called private blockchains. Initiatives like this one, this one and companies like Eris are advocating a kind of blockchain that is permissioned and uses different methods than the usual Proof of Work or Proof of Stake for reaching consensus (they just discovered Paxos).

I’m fine with people building software and selling it — but these cannot be called blockchains, because they aren’t. A blockchain could be defined as an append-only decentralized ledger, with consensus reached at a network level. The things these people are building are just replicated databases.

We met with both the CEO and the CTO of Nasdaq’s blockchain effort in some blockchain event in NY. The CEO was participating in a panel, and I asked him which blockchain they were using. I expected them using Bitcoin or Ethereum. He said they were using a custom blockchain.

Then we asked the CTO, and he basically said that they have a single node running their blockchain, and that their security model was perimetral security. Uhm… wait to see my badass MySQL instance! Oops I wanted to say my custom, tailor-made, business-focused, enterprise-ready blockchain.

But what’s somewhat frustrating too, is the fact that some people inside the community are usually confused too about very basic blockchain facts. For example, how can you not know that increasing the block size doesn’t solve memory pool problems?, or how can you be fooled by a random scammer saying he’s Satoshi. Because some people don’t even know how to verify a signature to see that they’ve been fooled.

Now I’ll quote Peter Thiel: “We wanted flying cars, instead we got 140 characters.”

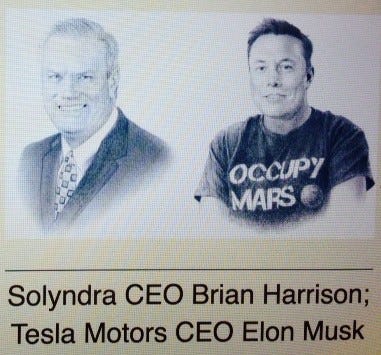

An this is because… well, I’ll use a picture from Peter’s book to make my point:

Now the scene is full of suits who have holistic, high level business understanding of the tech, while it’s difficult to see T-shirts with bold claims from people who actually build stuff.

Fortunately, I think blockchain’s hype cycle has peaked 3 months ago regarding VCs, so I look forward to the bullshit bubble to explode, so we are left with the actual things that make sense.

Because there are amazing things that the blockchain can provide. Here are some killer use cases:

Currency: Bitcoin, obviously

Decentralized storage: I love Sia, and I believe it’s a paradigm shift for storage

Notarization: Sometime in the next decade, the world will figure out that notary publics don’t make any sense, and that the technology that we have today already makes them obsolete. Also, you can notarize tons of stuff that you couldn’t before: emails, Dropbox documents… we do that

Prediction marketplaces: I love Augur, and it makes a lot of sense — for example predictions get way better enabling insiders to bet

Security: It’s the world first time that we have an immutable ledger with no root access whatsoever. This enables a new world regarding security, and we’re working to make it happen

And if you still think private blockchains are a thing, I don’t blame you, you are the result of an industry full of bullshitters — and we’re not born as experts in everything — but I strongly encourage you to read about it.

Nevertheless I’m hopeful, because I know the blockchain’s strength — to eventually set us free by controlling our own wealth — will remain available for every person on the planet, as long as the Internet stays there.

And, while all the bullshitters earn their quick money and go, the hackers will remain — silently decentralizing society again.